To facilitate the task of welding work with parts made of non-ferrous metals and stainless steel, it is necessary to use a welding oscillator. This useful device, which solves the problem of igniting the welding arc and maintaining it in a stable state, can be used equally successfully in production and at home.

Welding oscillator brand VSD-02, used to stabilize the arc

We understand the design and principle of operation of the oscillator

Welding oscillators, capable of working with AC and DC sources, are needed in order to simultaneously increase both the magnitude of the voltage and the frequency of the electrical current. If the voltage at the input of such a device is 220 V and the current frequency is 50 Hz, then the output is already 2500–3000 V and 150,000–300,000 Hz. The duration of the pulses created by the oscillator is tens of microseconds. The power of these devices, with the help of which high-frequency current and high voltage is supplied to the welding circuit, is 250–350 W.

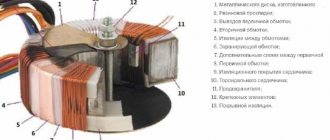

The technical capabilities that the oscillator has are provided by its design and the characteristics of its elements.

The electrical circuit of the device consists of the following components:

- an oscillatory circuit acting as a spark generator of damped oscillations (such a circuit includes a capacitor and an inductor - the moving winding of a high-frequency transformer);

- arrester;

- choke coils in the amount of two pieces;

- step-up transformer;

- high frequency transformer.

Functional diagram of the oscillator

In addition, the oscillator contains elements that ensure the safety of both the device itself and the welder. Such elements include a capacitor, which protects the welder from electric shock, and a fuse, which opens the electrical circuit if the capacitor breaks down.

The oscillator, which is used in conjunction with a welding machine, works according to the following principle. After passing through the windings of the step-up transformer, the voltage enters the capacitor of the oscillating circuit and begins to charge it. When a capacitor is charged to the value provided by its capacitance, it discharges a discharge to the spark gap, which leads to breakdown. After this, the oscillatory circuit becomes short-circuited, which causes the occurrence of resonant damped oscillations. The high-frequency current that forms these oscillations is supplied to the welding arc through a blocking capacitor and the coil winding.

An example of making an oscillator board

The blocking capacitor is designed in such a way that only high-frequency current, which also has a higher voltage value, can freely pass through it. Low-frequency current is not able to pass through such a capacitor due to too much resistance. Thanks to this characteristic of the blocking capacitor, low-frequency current from the welding machine cannot pass through it, which protects the oscillator from short circuits.

Device

The schematic diagram of the welding oscillator assumes the presence of the following blocks:

- A step-up transformer that converts the primary voltage values of the household network - 220 V, 60 Hz - into high-frequency oscillations with a frequency of up to 250 kHz, while simultaneously increasing the voltage to 5...6 kV.

- A spark generator of damped oscillations, which is a single-circuit spark gap whose contacts are erosion-resistant tungsten electrodes.

- The control branch, which includes an external power supply stabilizer, a ballast and a feedback line with a current sensor. During long-term operation, a gas valve will be required to prevent the oscillator from overheating.

- An output transformer, through which high voltage and high frequency current is transmitted to the contacts of the welding machine. In parallel, this transformer is connected to a current sensor.

- A safety unit that protects the welder and equipment from unacceptable excess current or arc voltage.

The design of the welding oscillator depends on the intensity of its use and the type of welding machine used. Thus, for welding aluminum, when direct current and reverse polarity are more often used, a serial connection is considered more profitable, and for short-term operations, as well as welding stainless steels, a parallel connection. Accordingly, the scheme will be different.

A series-connected welding oscillator consists of one transformer. A fuse and two smoothing capacitors are included in its primary winding, and a spark gap and an oscillating circuit (capacitor + inductor) are included in the secondary winding. The circuit of a welding oscillator with parallel connection is more complicated: it must have two transformers. In the primary winding of the first of them there is a double oscillatory circuit, and the secondary winding, together with a parallel-connected spark gap, constitutes the primary winding of the second, high-frequency transformer, from which the arc is powered. In addition to the complexity of assembly and adjustment, the parallel circuit requires special protection against exceeding the permissible voltage.

Types of welding oscillators

An oscillator, which, if desired, is easy to make with your own hands, can refer to:

- continuous devices;

- devices with pulse power.

Using oscillators of the first type, a high frequency current (150–250 kHz) and a high voltage value (3000–6000 V) is added to the welding current. The ignition of such an arc can be carried out even without the electrode touching the surface of the workpieces being connected, and the arc burns very steadily even at low values of current supplied from the welding machine. This is possible due to the high frequency of the current that the oscillator produces. What is important is that current with such characteristics is not dangerous for the welder performing work using this device.

Parallel and serial connection of the oscillator

The electrical circuit in which the first type of oscillator is involved may provide for its parallel or serial connection. Devices that are connected to the electrical circuit of the welding machine in series are more efficient. This is explained by the fact that their circuit does not use high voltage protection as unnecessary.

A welding oscillator with pulse power is required primarily when welding is performed on alternating current. In addition to the initial ignition of the welding arc, a device of this type provides its support when changing the polarity of the alternating current, which occurs constantly. Oscillators of the first type, under conditions of constant change in the polarity of alternating current, do not cope well with re-ignition of the arc, which negatively affects the quality of welding operations.

Oscillators, the electrical circuit of which contains capacitors that accumulate charge from a special charger, are also capable of contactless ignition of the welding arc. At those moments when it is necessary to re-ignite the arc, these capacitors are discharged, and the electric current of their discharge is supplied to the arc gap. The electrical circuit of such a welding oscillator contains a device that ensures synchronization of capacitor discharges at those moments when the electric arc current passes through zero.

As for the rules for using oscillators, it is necessary to take into account that welding of aluminum with their help is carried out using alternating current, and stainless steel - using direct current of direct polarity.

Rules for operating oscillators

The use of an oscillator for welding aluminum, other non-ferrous metals or stainless steel requires compliance with a number of simple rules that will make working with such a device comfortable and safe.

- Oscillators can be used both indoors and outdoors.

- It is not recommended to use welding oscillators outdoors if it is raining or snowing outside.

- It is allowed to work with such devices at ambient temperatures from –10 to +40 degrees Celsius.

- It is permissible to use oscillators at ambient humidity levels not exceeding 98%.

- The atmospheric pressure at which such devices can be used must be in the range of 85–106 kilopascals.

- It is not recommended to use such a device in rooms where the atmosphere is heavily polluted with dust, caustic vapors and gases that can destroy insulation and metal.

- You can start working with the welding oscillator only if it is reliably grounded.

- Before starting work, you should always check whether the device is correctly connected to the welding circuit and whether its contacts are working properly.

- The oscillator casing must always be put on during welding work; it can only be removed when the device is disconnected from the electrical network.

- The working surface of the spark gap must always be kept clean and free of carbon deposits. If carbon deposits appear, it must be removed using sandpaper.

You can not only buy such a device, which will help you weld non-ferrous metals and stainless steel, but also make it yourself.

Tinkoff Company Blog Investments | Five fantastic oscillators for stock trading

Is it difficult for an uninitiated person looking at a stock price chart to understand when to buy and sell shares? The trained eye of a trader will notice patterns in price behavior.

In reality, there is nothing difficult about reading charts if you practice. After all, for example, if you wake up in an unfamiliar place and look out the window, you will be able to determine with a high probability whether it is day or night. At the same time, you can guess the time of year and the approximate weather. And then you’ll decide what to wear before going out. Why did they decide this? Surely there is some secret?

You received signals on the basis of which you built a logical chain:

- The sun is shining. Conclusion: like a day. Unless this is Stockholm, where at three o'clock in the morning it is as bright as at noon.

- Green foliage on the trees. Conclusion: probably spring or summer. Unless the house is in the middle of a giant greenhouse in the snow.

- Swifts are flying in the sky. Conclusion: it’s daytime, May-August, and we’re definitely not in a greenhouse.

Solution: We put on summer clothes. Profit!

Also, an experienced trader, looking at the chart, will predict the further price movement.

Signals from the outside are formed into patterns, patterns, sequences. By the way, they are used by trading robots (which, according to CNBC, control 80% of the US stock market). When the robot’s algorithm detects a certain pattern in price behavior and it coincides with the confirming signals of other indicators, the command “buy” or “sell” follows. The programmer’s task is to describe the process of entering and exiting a trade in as much detail as possible.

To describe trading programs, stock oscillators are used - tools for predicting prices. Let's look at the five most popular ones for trend trading.

Recently, a widget with stock charts of TradingView.com, a startup launched in 2011 by three Russian guys and raised $3.6 million from various funds, appeared in the Tinkoff Investments web terminal. Now TradingView is one of the most popular technical analysis tools in the world.

Where did oscillators come from?

Most oscillators were invented in the 30s of the last century. During the Great Depression, financial analysts suddenly had a lot of time... The sharpest minds began to hone their own trading rules and publish scientific papers. This is how the world learned about Elliott waves, Gann fan, Wyckoff sequence and others.

It is not necessary to know all oscillators. Typically, a trader uses three or four that best suit his trading style.

The task of oscillators is to answer the question of whether a stock is worth selling or buying at a given moment, as well as to predict the direction of the trend.

How to call oscillators in the Tinkoff trading terminal?

We go from the computer to the address https://www.tinkoff.ru/invest-terminal/

- Click “Add widget”;

- Add “TradingView Chart”;

- Click on the “Indicators” icon and look for the one you need.

It is important to remember that you should not use just one indicator. They need to be combined with each other. Most indicators are lagging, that is, the signals lag behind the real market picture.

Before moving on to the TOP 5, let’s define two technical analysis terms.

1. What are support and resistance levels?

The support level (or simply support, in English support) is the price range from which the price turns upward. This level seems to support the price, preventing it from going lower.

Lukoil (LKOH), daily chart April-September 2020

The resistance level prevents the price from going up.

The mirror level acts as both support and resistance.

Level trading is my favorite strategy. The main thing is to find the entry point correctly. This method is ideal for stocks whose price moves sideways (horizontally).

Sometimes, instead of sideways, the stock is traded in an ascending or descending channel, like Alrosa (ALRS).

Alrosa, April-September 2020

We buy at the lower border of the channel, set the first take profit in the middle, and the second at the top.

TradingView's drawing tools allow you to look for patterns like these. 2. What are convergence and divergence?

When a stock falls and the oscillator points to growth, this effect is called convergence.

When a stock is rising and the oscillator is indicating a fall, this effect is called divergence.

I confuse these concepts, so I simply call such patterns divergence, and true traders also add bullish or bearish ones.

The MACD oscillator was created to search for divergences.

MACD (Moving Average Convergence/Divergence) – moving average convergence-divergence indicator

How to trade MACD: when divergence is detected, be prepared to open or close a trade.

Below on the daily chart of Westrock (WRK) the green line indicates growth.

Westrock, September 2022 – July 2018

Let's look at the lower window with MACD and see the opposite picture - divergence, which indicates a possible decline (red line). And so it happened: the two-year upward trend was interrupted.

But…

The signal from one oscillator is not enough, so you need to find confirmation from other sources.

Everything is like in intelligence. We call RSI for help. RSI (Relative strength index) – Relative Strength Index

This is probably the most popular oscillator in technical analysis. RSI is displayed in the lower window and is a curve that ranges from 0 to 100.

How to trade:

- If the curve is drawn above or near 70, then the stock is overbought. We sell.

- If it is below or around 30, then it is oversold. We buy.

Westrock, September 2022 – July 2018

The RSI shows that there are a lot of buyers in Westrock stock.

We already have two signals from MACD and RSI for a possible correction. The decision is yours. EMA (Exponential Moving Average) - Exponential moving averages

From April to September 2022, Amazon shares grew by 85%, renewing and renewing all-time highs. In conditions of such powerful growth, the support and resistance lines have nowhere to come from, so moving averages are used to trade on rate fluctuations (swing trading).

The moving average represents the average stock price over N days (hours, minutes).

In the case of Amazon, the 20-day moving average acted as a support level.

Amazon, February-September 2020

How to trade:

- The strategy works for fast-growing stocks (AAPL, AMZN, NVDA, TSLA, etc.).

- When the price touches the EMA above, you can buy;

- Place stop losses under the EMA.

Some stocks perform well on 20-day trailing days, others on 50-day moving averages.

Bollinger Bands

This oscillator consists of three moving averages that cover the price chart from above and below, forming a channel. Bollinger works better in conjunction with other indicators, as it is auxiliary. However, it is often used instead of support-resistance levels and EMA.

Tyson Foods, May-September 2020

How to trade:

- When the price reaches the lower moving average, you can buy;

- Before a powerful price shot, the channel often narrows like a spring;

- Look for the letter W on the graph. The first low should touch the line or below, the second closes higher - a buy signal.

Severstal, November 2022 - March 2018

Let's add some magic.

Fibonacci levels

The Oscillator represents a grid that is superimposed on the price chart from the beginning to the end of a strong trend. Support and resistance levels will often coincide with this grid.

Cisco

How to trade: the same as from support-resistance.

Lukoil

Boeing

OBV (On Balance Volume) – On Balance Volume

OBV is a leading oscillator. You can predict a trend reversal in advance if you work with cash flow volumes.

How to trade: looking for divergences. If quotes rise and volumes fall, then this is a signal that there will be a correction.

Since mid-2022, Magnit (MGNT) shares have been growing, but the volume of transactions has been falling. Then there was the last jerk - and the abyss down. The paper has not yet returned to current levels...

Magnit, 2017

So, you have learned about five popular indicators that hundreds of thousands of people use to trade on the stock exchange.

There is a lot of information published online on how to work with it. Technical analysis coupled with fundamental analysis is a powerful weapon. conclusions

- Indicators give signals. Recognizing them requires training;

- Use multiple indicators. Signals alone are often not enough to make a decision;

- Study the indicator you like in more detail. You have only seen some examples.

- Technical analysis is interesting. But not a panacea. Nobody canceled the fundamental.

Happy bidding!

PS Do you know who doesn’t need technical analysis? Long-term investors. Happy people!

Author: Artur Malosiev, profile in Pulse - svechi.

The author's opinion may not coincide with the opinion of the Tinkoff Investments editorial team. Securities and other financial instruments mentioned in this review are provided for informational purposes only; The review does not constitute an investment idea, advice, recommendation, or offer to buy or sell securities or other financial instruments.