The balance sheet reflects the composition of the organization's assets and liabilities as of the date of its formation. As a rule, the balance sheet is drawn up at the end of the reporting period (quarter, year). The asset reflects the property, that is, the assets of the enterprise, and the liability reflects the equity and liabilities. The balance sheet results are equal, therefore, by analyzing the data by calculating various indicators, it is possible to determine : – the structure and dynamics of individual indicators; – assess solvency and financial stability; – analyze the liquidity of the balance sheet.

Formation of indicators for analyzing the organization’s balance sheet

The balance sheet is the main reporting document of any organization.

The composition of its indicators may vary from company to company, but the analysis is based on general principles and methods. ATTENTION! From 2022, financial statements will be submitted exclusively in electronic form. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here. We also remind you that in 2022 the reporting forms have been updated.

Analysis of the balance sheet is of practical importance if it is based on reliable information. To avoid its distortions (accidental or intentional), the enterprise must have an internal control system (Article 19 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). And to externally confirm the reliability of the balance sheet, an audit is used (clause 3 of the Law “On Auditing” dated December 30, 2008 No. 307-FZ). In some cases this is mandatory (Article 5 of Law No. 307-FZ). The list of companies subject to mandatory reporting audit can be found on the website of the Russian Ministry of Finance.

All mandatory accounting reports must meet the requirements for them: comparability, consistency, etc.

Look at a sample balance sheet prepared by ConsultantPlus experts. Get trial access to the system and proceed to the material. It's free.

For more information about what requirements the balance sheet must meet, see the material “What requirements must accounting records satisfy? ”

Let's consider the main stages of the analysis of the balance sheet.

Analysis of the balance sheet using an example: preliminary stage

Let's consider an example of analyzing the balance sheet of an enterprise. The balance sheet of Sekunda LLC as of December 31, 2020 is as follows:

| Indicator name | Code | As of 12/31/2020 | As of 12/31/2019 | As of 12/31/2018 |

| ASSETS | ||||

| Fixed assets | 1150 | 320 | 250 | 200 |

| Reserves | 1210 | 205 | 160 | 115 |

| Accounts receivable | 1230 | 170 | 190 | 160 |

| Financial investments (excluding cash equivalents) | 1240 | 50 | 50 | — |

| Cash and cash equivalents | 1250 | 120 | 210 | 25 |

| BALANCE | 1600 | 865 | 860 | 500 |

| PASSIVE | ||||

| Authorized capital | 1310 | 10 | 10 | 10 |

| retained earnings | 1370 | 385 | 210 | 85 |

| Accounts payable | 1520 | 470 | 640 | 405 |

| BALANCE | 1700 | 865 | 860 | 500 |

The first reading of this report can be called introductory: the balance sheet figures assess the general structure of property and liabilities, the availability of raised funds, etc.

In this case, we are dealing with a developing company: an annual increase in the balance sheet currency, the appearance of financial investments in the asset structure, an increase in the cost of fixed assets (which may indicate the company’s intentions to invest in the development of its production potential), a steady decrease in debts - and all this without attracting long-term borrowed funds.

Preliminary conclusions have been made and we can proceed to a more detailed analysis. To do this, we will conduct a horizontal and vertical analysis of the balance sheet.

Analysis of the obtained values

The balance displays the balance status and meets a number of requirements:

- The balance sheet currency at the end of the period under review increases relative to the beginning of the period.

- The rate of currency growth exceeds the rate of inflation, but is less than the rate of revenue growth.

- The rate of increase in current assets is higher than the rate of growth of non-current values and short-term debts.

- The volume of long-term borrowed funds is greater than the values for non-current assets.

- The amount of equity capital is at least 50%.

- All parameters (rate, volume) of receivables and payables are approximately the same.

- There are no uncovered losses or they are extremely small.

IMPORTANT! When analyzing, you need to pay attention to new trends in accounting methods and changes in accounting policies.

Horizontal analysis of the balance sheet

Using horizontal analysis, we compare the balance sheet indicators by reporting dates (to simplify the example, we use data at the beginning and end of the reporting period):

| Balance sheet item | As of 12/31/2020 | As of 12/31/2019 | Deviation (+/–) | |

| sum | % | |||

| Property dynamics | ||||

| Including: non-current (OS) | 320 | 250 | +70 | +28,00 |

| negotiable | 545 | 610 | –65 | –10,65 |

| Reserves | 205 | 160 | +45 | +28,13 |

| Accounts receivable | 170 | 190 | -20 | –10,53 |

| Financial investments (excluding cash equivalents) | 50 | 50 | – | – |

| Cash and cash equivalents | 120 | 210 | -90 | –42,86 |

| Capital dynamics | ||||

| Including: equity | 395 | 220 | +175 | +79,55 |

| Authorized capital | 10 | 10 | – | – |

| retained earnings | 385 | 210 | +175 | 83,33 |

| borrowed capital | 470 | 640 | –170 | –26,56 |

| Sources of funds in calculations (accounts payable) | 470 | 640 | –170 | –26,56 |

A horizontal analysis of the balance sheet showed the following: during the reporting period, non-current assets increased by 28%, which may indicate the expansion of activities and growth of the company’s economic potential. At the same time, working capital decreased (by 10.65%) - mainly due to a decrease in cash balances (by 42.86%). There was an increase in working capital in inventories by 28.13%, which indicates a decrease in liquidity and may affect the solvency of the company. The presence of short-term financial investments in the current assets indicates a desire to invest funds in order to obtain additional profit. The growth of the balance sheet currency must also be compared with the rate of inflation and revenue growth.

If you have access to ConsultantPlus, find out how to assess the solvency of a counterparty based on the balance sheet. If you don't have access, get a free trial of online legal access.

What does the share of working capital in assets show and how is it calculated?

The share of working capital (WC) in the company’s assets is calculated using the formula:

DO = OS / A,

Where:

OS - the total amount of the company's working capital as of a certain date;

A is the value of all assets as of the same date.

In order to calculate the first indicator, you need to add up the indicators on the following lines of the organization’s balance sheet:

- 1240 (financial investments);

- 1250 (enterprise cash, as well as cash equivalents);

- 1230 (accounts receivable);

- 1210 (enterprise inventories);

- 1220 (VAT on acquired values);

- 1260 (other assets classified as current).

The company's accounting policy may provide for the exclusion from current assets of long-term (with a maturity of more than 12 months), as well as low-liquidity (with prospects of non-payment) receivables.

On the one hand, the inclusion of these types of receivables in the current assets of the balance sheet from the point of view of financial law can be considered as a completely natural solution. On the other hand, at the level of recommendations of Russian regulators (in particular, given in the letter of the Ministry of Finance of the Russian Federation dated January 24, 2011 No. 07-02-18/01), as well as IFRS standards (enshrined, in particular, in paragraph 60 of the IAS 1 standard) you can find formulations according to which low-liquid and long-term receivables can be classified as a non-current asset. In this case, its amount will not be included in the formula under consideration.

The second indicator of the formula corresponds to the value reflected in line 1600 of the balance sheet.

Determination of the structure of articles (vertical analysis) and the share of indicators

Using this type of balance sheet analysis, we examine the structure of indicators over time:

| Balance sheet item | As of 12/31/2020 | As of 12/31/2019 | Shifts in structure, % | ||

| sum | % to total | sum | % to total | ||

| Property structure | |||||

| Including: non-current assets (OC) | 320 | 36,99 | 250 | 29,07 | +7,92 |

| current assets | 545 | 63,01 | 610 | 70,93 | –7,92 |

| Reserves | 205 | 37,61 | 160 | 26,23 | +11,38 |

| Accounts receivable | 170 | 31,20 | 190 | 31,15 | +0,05 |

| Financial investments (excluding cash equivalents) | 50 | 9,17 | 50 | 9,17 | – |

| Cash and cash equivalents | 120 | 22,02 | 210 | 34,43 | -12,41 |

| Capital structure | |||||

| Including: equity | 395 | 45,66 | 220 | 25,58 | +2,02 |

| borrowed capital | 470 | 54,36 | 640 | 74,42 | – |

A vertical analysis of the balance sheet showed that during the reporting period there were no significant changes in the overall structure of property and capital.

The growth of non-current assets amounted to 7.92%. In the structure of current assets, small structural changes are observed in the lines “Cash and cash equivalents” (12.41%) and inventories (11.38%). An increase in working capital in inventories reduces their turnover, which may negatively affect current liquidity. The share of equity in the balance sheet currency amounted to 45.66% at the end of the period, mainly due to the share of retained earnings in equity (97.47%). There are no uncovered losses on the balance sheet.

The company does without long-term loans and borrowings, that is, the volume and structure of equity capital allows it to organize the production process and develop without external borrowings.

Solvency and financial stability of the enterprise

The solvency of an enterprise according to the balance sheet is calculated by determining the amount of its own working capital. This indicator is also called net current assets. This indicator is defined as the difference between current assets and short-term liabilities. That is, the difference between the balance lines:

A h t = 1200 – 1500 A_{h} =1200–1500 A ht=1200–1500

Thus, the company has its own working capital as long as current assets exceed short-term liabilities, and the amount of the excess characterizes the solvency of the enterprise.

The financial stability of an enterprise is determined by constructing a three-factor model:

M = ( ∆ S O S ; ∆ S D I ; ∆ O IZ ) M = (∆SOS; ∆SDI; ∆OIZ) M=(∆SOS;∆SDI;∆OIZ)

Table 1 shows the calculation of indicators for this model.

Table 1 - Indicators for determining the type of financial stability

| Indicators | Calculation formula | Regulatory restriction |

| ΔSOS | (p.1300 – p.1100) – p.1210 | ΔSOS ≥ 0, M=1 ΔSOS < 0, M=0 |

| ΔSDI | (p. 1300 – p. 1100 + p. 1400) – p. 1210 | ΔSDI ≥ 0, M=1 ΔSDI < 0, M=0 |

| ΔOIZ | (p. 1300 - p. 1100 + p. 1400 + p. 1500) – p. 1210 | ΔOIZ ≥ 0, M=1 ΔOIZ < 0, M=0 |

The obtained indicators of the provision of reserves with relevant sources of financing are transformed into a three-factor model (M):

M = ( ∆ S O S ; ∆ S D I ; ∆ O IZ ) M = (∆SOS; ∆SDI; ∆OIZ) M=(∆SOS;∆SDI;∆OIZ)

Using this model, you can determine the type of financial stability, which are presented in Table 2.

Table 2 – Types of financial stability

| Type of financial stability | 3D model |

| 1. Absolute financial stability | M = (1,1,1) |

| 2. Normal financial stability | M = (0,1,1) |

| 3. Unstable financial condition | M = (0,0,1) |

| 4. Crisis (critical) financial condition | M = (0,0,0) |

Analyzing the Balance Sheet Using Financial Ratios

By calculating special coefficients, further analysis of the balance sheet is carried out:

Solvency analysis

| Coefficient | Calculation | Recommended Range | |

| Formula | Sum | ||

| Financial dependency ratio. Read more about the coefficient in the article “Financial dependence coefficient (balance sheet formula)” | Balance sheet currency / equity | 865 / 395 = 2,2 | ≤2,0 |

| Financial independence ratio. Read more about the coefficient in the article “Financial independence coefficient (formula)” | Own capital / balance sheet currency | 395 / 865 = 0,46 | ≥0,5 |

| Total Solvency Ratio | Balance sheet currency / borrowed capital | 865 / 470 = 1,84 | ≥1,0 |

| Debt ratio | Debt capital/equity | 470 / 395 = 1,19 | ≤1,0 |

Liquidity analysis

| Coefficient | Calculation | Recommended Range | |

| Formula | Sum | ||

| Instant liquidity ratio | (DS and DE)*/ KO*** | 120 / 470 = 0,26 | >0,8 |

| Absolute liquidity ratio | (DS and DE + KFV**) / KO | (120+50) / 470 = 0,36 | >0,2 |

| Quick ratio | (DS and DE + KFV + DZ) / KO | (120 + 50 + 170) / 470 = 0,72 | ≥1,0 |

| Average liquidity ratio | (DS and DE + KFV + DZ + Reserves) / KO | (120 + 50 + 170 + 205) / 470 = 1,16 | >2,0 |

| Intermediate liquidity ratio | (DS and DE + KFV + DZ + Inventories + VAT) / KO | (120 + 50 + 170 + 205) / 470 = 1,16 | ≥1,0 |

| Current ratio | Current assets / KO | 545 / 470 = 1,16 | 1,5–2,0 |

* (DS and DE) - cash and cash equivalents.

** KFV - short-term financial. attachments.

*** KO - short-term liabilities.

For more information about liquidity ratios, read the article “Calculation of the liquidity ratio (balance sheet formula)” .

An analysis of the balance sheet using financial ratios showed that solvency indicators are close to the recommended ones. However, the instant, quick and current liquidity ratios show the insufficiency of working capital to repay short-term liabilities at the reporting date.

In addition, it is necessary to calculate financial stability coefficients (autonomy, agility, etc.).

Our articles will help you do this:

- “What does the autonomy coefficient show - the balance formula?”;

- “Agility coefficient (balance sheet formula)” and other materials in the “Analysis of Economic Activity (ABA)” .

Answers to frequently asked questions

What is the valuation of balance sheet items and why is it needed?

Balance sheet valuations are ways of measuring monetary values of assets, liabilities, income and expenses on the balance sheet.

The preparation of a balance sheet is subject to a number of specific requirements and rules. These include a method for estimating the amount that will fall into a specific line of the balance sheet, regardless of whether it is located in its assets or liabilities.

Knowledge of the rules and methods for valuing balance sheet items helps to correctly formulate all the amounts on the balance sheet lines. This is the basis without which it is impossible to obtain correctly compiled reports. These rules help make reporting more reliable, as well as avoid fines for distortion.

Trend, factor and comparative analysis

In addition to the above stages of balance sheet analysis, trend, factor and comparative types of analysis can be carried out. They will complement and expand the volume of analytical data for making the necessary economic decisions.

Thanks to trend analysis, you can form an opinion about the main trend of changes in certain indicators (predictive analysis).

For example, a joint study of the dynamics of short-term debt and cash:

| Balance indicator | As of 12/31/2018 | As of 12/31/2019 | As of 12/31/2020 |

| Accounts payable | 405 | 640 | 470 |

| Cash and cash equivalents | 25 | 210 | 120 |

From the above figures it follows that, as of reporting dates, the nature of changes in the amount of short-term debts corresponds to changes in the volume of cash, but the company’s free cash is not enough to repay these debts.

Using factor analysis, the nature of the influence of the main factors on the change in the value of the indicator under study is determined. It is carried out according to a certain method of analyzing the balance sheet.

To carry out a comparative analysis, additional information is needed - the balance sheet data of one company is not enough. This is due to the fact that when carrying out this type of analysis, the balance sheet indicators of different companies are compared in order to determine their rating.

Specifics of analyzing the balance sheet of individual companies using the example of a bank balance sheet (Form 1)

Banks, although they are commercial companies and are created to make a profit, have specific features. They are subject to special legislation, maintain a special chart of accounts and build a different methodology for accounting processes.

At the same time, the main approaches to analyzing a bank’s balance sheet are in many ways similar to analyzing the balance sheet of an ordinary commercial company. For the bank balance sheet, the main stages of analysis also remain relevant:

- preliminary (reading the balance sheet, structuring its items, etc.),

- analytical (description of calculated indicators of structure, dynamics, relationship between balance sheet indicators);

- final (evaluation of analysis results).

In the process of analyzing the bank’s balance sheet, special coefficients are also calculated, but their types differ from those discussed earlier:

- bank reliability coefficient (capital adequacy ratio),

- return on assets ratio (shows the efficiency of using assets and quality based on their profitability),

- leverage ratio (interbank loans), etc.

To learn how banks analyze the creditworthiness of their clients, read the material “Methods for assessing the creditworthiness of commercial bank clients.”

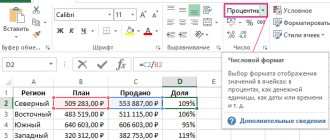

Online program to facilitate the analysis process

Modern information processing tools can significantly simplify the process of comprehensive analysis of the balance sheet. Calculations are carried out both using standard computer programs (for example, using Excel, where you can carry out calculations, create tables and charts), and using specialized programs that allow you to conduct financial analysis online - via the Internet.

The use of specialized software not only saves time, but also significantly expands the types of analysis. They allow you to analyze market stability, business activity, score assessment of financial stability, etc. In addition, developers of specialized programs provide the possibility of adapting and changing the program depending on the goals and objectives of the analysis, taking into account the specifics of a particular enterprise.

conclusions

The balance sheet reflects the company's assets and the sources of its formation.

As a result of the analysis of the balance sheet, the dynamics of assets and liabilities are revealed and its causes are established. In this case, the balance sheet total for the year may increase or decrease.

Submit accounting and any other reports in the Astral Report 5.0 service. Our users always have access to the latest versions of all types of reports and declarations. And the list of to-dos on the main page will remind you of the deadlines for submitting reports and show an unanswered request from the Federal Tax Service.

Results

Analysis of balance sheet indicators is a voluminous and multi-stage process. Its results make it possible to identify potential risks, develop the financial policy of the enterprise and contribute to effective management decisions. The analysis process can be facilitated by using specialized programs.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Federal Law of December 30, 2008 No. 307-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is weight in statistics?

Statistical weight, in quantum mechanics and quantum statistics, is the number of different quantum states with a given energy, that is, the multiplicity of the state. If the energy takes on a continuous series of values, the Statistical weight is understood as the number of states in a given energy interval.

Interesting materials:

Who is the author of the phrase Leopold the cat? Who is the author of books about Dunno? Who is the author of the song Plantain Grass? Who is the author of the voice program? Who is the author of the work boys? Who is the author of the work on the bottom? Who is the author of the story Cosette? Who is the author of the Sistine Madonna? Who is the author of the fairy tale about Winnie the Pooh? Who is the author of the fairy tale The Blue Bird?