In conditions of instability and constantly changing trends in economic development, the search for new competitive advantages, for example, ways to reduce production costs, increase the profitability of sales and demand, reduce selling prices, increase attention from buyers, etc., becomes especially important.

In solving these problems, a qualitative calculation of product costs plays an important role.

The optimal options for its calculation, as well as automated software tools for such calculations, will be discussed in this article. Cost is the sum of costs, that is, resources (materials, raw materials, semi-finished products, energy, work of hired employees) that a manufacturer spends during the production of products and bringing them to the consumer, but expressed directly in monetary form.

Cost calculation will help in processes such as:

- profitability assessment;

- justification for pricing (wholesale, retail);

- assessment of the efficiency of use of production resources;

- calculation of the potential profit of the enterprise.

Cost calculation can be done:

- in one stage, when the cost per unit of production is initially calculated;

The choice of cost calculation method depends, first of all, on the type of cost we are interested in:

- Planned , it is also normative . Calculated on the basis of resource consumption rates (raw materials, supplies, work, etc.) predetermined for the production of each unit of production;

- Actual cost . It is calculated by analogy with the planned one, but already represents the amount of the enterprise’s actual production costs incurred at the end of the reporting period. If the actual indicator does not coincide with the planned one, a comparative analysis is carried out to identify the reasons for the discrepancy;

- Estimated cost - calculated for one-time orders and products, being a variation of the standard cost.

To correctly calculate each type, costs should be classified correctly.

Which costs are variable?

Variable costs are those that depend on the volume of production. That is, they increase when the scale of output increases and decrease when it decreases. The main feature that allows expenses to be classified as variable is their complete zeroing when production slows down.

Take our proprietary course on choosing stocks on the stock market → training course

Variable costs are the object of careful study in management accounting. Together with fixed costs, they constitute total costs, reserves for reducing which are usually sought precisely among their variable component.

The nature of the dependence of variable costs on production volume may be different. In accordance with this feature, such costs are divided into types presented in the table.

| Naming of expenditures | Description | Example |

| Proportional | An increase in production volumes entails an increase in the variable component of total expenses in the same proportion | Production volume increased by 25% and variable costs also increased by the same 25% |

| Degressive | Production volumes are growing at a much faster rate than variable costs | Production volume increased by 45%, and the variable component of all expenses by only 10% |

| Progressive | The growth rate of variable costs outpaces the rate of increase in output volumes | Production volume increased by only 20%, and variable costs increased by as much as 40% |

Also, variable costs are divided on the basis of attribution to cost into direct (which can be attributed directly to the manufacture of a specific type of product) and indirect (which also depend on production volumes, but they are very difficult to attribute to a specific type of product).

According to the method of inclusion in the production process, variable costs are divided into production and non-production.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

How changes in the cost of raw materials affect the cost of production

In practice, a situation regularly occurs when the cost of raw materials and, accordingly, the cost of finished products changes. To account for changes, the average cost, FIFO and LIFO methods are used. The FIFO method (FIFO, First in First out, “first in, first out”) implies that the raw materials that were purchased earlier are used for production first. This method is more often used for goods with a short shelf life. LIFO method (LIFO, Last in First out, “last in, first out”) - those stocks that arrived later are released into production. This is convenient if the amount of inventory is large. The average cost method involves dividing the total cost of all inventory by the quantity of inventory.

Let's consider these methods using the example of changes in the cost of purchased flour in April:

- 1 batch 300 kg, purchased at a price of 20 rubles;

- 2nd batch 200 kg, price 45 rubles;

- 3rd batch 500 kg, price 30 rubles.

According to the FIFO method, they will first write off flour for production at a price of 20 rubles, when this batch runs out, they will begin to write off a second one, costing 45 rubles. According to the LIFO method, on the contrary, inventories will begin to be written off to production from the last batch.

In the average cost method, the calculation of the cost of written-off material will be as follows: (20 x 300 + 45 x 200 + 30 x 500): 1000 = 30 (rub.)

When the product is sent for sale, you can use any of these methods to determine its cost. The company itself determines which calculation method it uses, depending on the volume of production and the type of product. You can recalculate the average cost at regular intervals, for example, once a month or as new batches are released. It is not advisable to change the selected calculation method - the indicators may be distorted.

What are variable costs?

Each company has its own examples of variable costs. Costs that are considered variable in one company may be considered constant in another organization.

Examples of variable costs in manufacturing

As mentioned above, a feature of variable costs is their correlation with actual production volume. Per unit of production they remain unchanged. But their total mass increases with increasing output.

At production enterprises, variable costs usually include the following items:

- Payment for raw materials and material resources;

- Purchase of semi-finished products used to create products;

- Electricity needed for production purposes;

- Remuneration for the labor of workers engaged in production (usually piece rates are present here);

- Mandatory contributions to the payroll funds of workers specified in the previous paragraph;

- The cost of services of third-party companies (for example, transport organizations, the need for whose services grows as the mass of goods requiring transportation increases).

How to reduce production costs

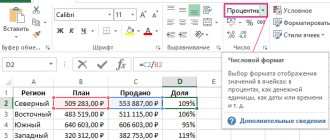

Reducing costs will allow the company to operate more efficiently and, depending on its goals, earn more or have a competitive price. Mikhail decided to find out if he could reduce the cost of his products and calculated different savings options in the table:

Option 1. Reducing the cost of raw materials

You can buy larger quantities, negotiate a discount, or find a new supplier. Mikhail’s most expensive direct cost item is minced meat; reducing its cost by 5% results in a reduction in cost by 3 rubles.

Option 2. Increasing labor productivity

The more products are produced, the lower the indirect costs per unit of production. You can make workplaces more convenient, optimize work and motivate employees. If you increase the number of dumplings produced by 20%, then the cost will fall by 13 rubles. Plus, production will require more raw materials, therefore, you can ask the supplier for more favorable conditions.

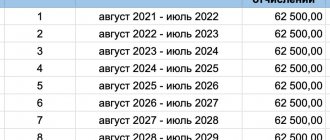

Option 3. Automation of production

This method will allow you to replace employees with equipment and save on labor costs. Of course, you need to maintain a balance; too expensive equipment may not pay for itself with small volumes. Mikhail plans to buy an automatic machine for 150,000 rubles for making dumplings. Its installation will eliminate the need for one of the kitchen workers. Despite the high cost, its depreciation will be 6,250 rubles with an estimated service life of 24 months. This is significantly less than the employee's salary. As a result of production modernization, the cost of dumplings will decrease by 13 rubles.

Option 4. Saving electricity, water, reducing rent

They will also lead to a reduction in indirect costs and a reduction in production costs. Reducing these costs by 25% will reduce the cost of production by 5 rubles.

Oksana Bondarenko, director:

“With the help of cost, you can not only formulate a pricing policy, but also monitor the success of your business. For example, if the cost goes down, this is a good sign. The more a business produces, the smaller the share of expenses in expenses begins to be taken up by renting premises and depreciation. Costs are also reduced by increasing the efficiency of employees: we produce more, but we pay the same as before.”

Variable Cost Examples

According to international financial reporting standards, all variable expenses of a company are divided into direct and indirect.

Indirect variable costs are affected by changes in production volumes. But due to the peculiarities of production technology, it is not possible to directly attribute them to the cost of the manufactured product.

At the same time, variable direct costs are directly related to the cost of a certain type of product. The source of information on them are accounting registers.

The following items can be cited as an example of direct variable costs:

- Labor remuneration for workers involved in the production of certain types of goods (with mandatory contributions to funds from their payroll);

- Material and raw materials resources, components;

- Fuel and energy resources necessary for the operation of mechanisms and machines that produce specific products.

Indirect variable costs include costs such as:

- Payment for material resources used in complex production processes;

- Financing of innovative developments;

- Payment for business trips of employees, etc.

Analysis of the cost of products (works, services). Analysis of investment projects under risk conditions

Analysis of the cost of products (works, services)

6.1. Meaning, objectives and sources of information for analysis

In a market economy, the cost of production is one of the important qualitative indicators of the production and economic activities of enterprises and their structural divisions. Reducing the cost of products (works, services) through the rational use of production resources is the main way to increase profits and increase the profitability of production.

The cost indicator represents the enterprise's costs expressed in monetary terms for the production and sale of products (works, services). The cost level reflects economic, scientific, technical, social and environmental factors of the enterprise's development.

The main tasks of analyzing the cost of production of an enterprise are as follows:

- assessment of the dynamics of the most important cost indicators and implementation of the plan for them;

- identification of factors influencing the dynamics of indicators and implementation of the plan, the magnitude and reasons for deviations of actual costs from planned ones;

- assessment of the dynamics and implementation of the cost plan in terms of elements and cost items, the cost of the most important products;

- identifying missed opportunities to reduce product costs.

Sources of information for analyzing the cost of production are planned calculations, forms No. 5 “Appendix to the Balance Sheet”, No. 5-z “Information on the costs of production and sale of products (works, services) of an enterprise (organization)”, No. P-4 “Information on the number, wages and movement of workers,” No. 1-“Information on the number and wages of workers by type of activity.” In addition, planned and reporting calculations for the most important products, accounting registers (statements, order journals), data on norms and standards contained in technological maps and specifications, etc. are used as sources of information.

To effectively manage costs, it is necessary to use an economically sound classification of costs according to certain criteria.

This will help not only to better plan and take into account costs, but also to analyze them more accurately, as well as identify certain relationships between individual types of costs and calculate the degree of their influence on the level of cost and profitability of products. Let's look at the main features of cost classification in table. 6.1. Table 6.1. Classification of costs according to certain characteristics

| No. | Classification sign | Types of costs |

| 1 | On making management decisions | Explicit and alternative |

| 2 | By economic role in the production process | Basic and invoices |

| 3 | By the method of attribution to individual types of products | Direct and indirect (indirect) |

| 4 | In relation to the volume of production and sales of products | Variables and constants |

| 5 | By time of occurrence | Current, future and upcoming |

| 6 | According to calculation criteria | By cost elements and by costing items |

| 7 | To exercise control | By places of formation and centers of responsibility |

Explicit costs are the expected costs that an enterprise must bear in carrying out its production and commercial activities.

The costs caused by the refusal of one product in favor of another are called alternative. They mean improved benefit when choosing one action precludes the occurrence of another action. Opportunity costs arise when resources are limited.

The main costs are those directly related to the technological process of manufacturing products. These include: the cost of raw materials, materials and semi-finished products that are materially included in the product; the cost of fuel and energy spent for technological purposes; expenses for remuneration of production workers and contributions for social needs; expenses for operating machinery and equipment, etc.

Overhead costs arise in connection with the organization, maintenance of production, sales of products and management. They consist of administrative and commercial expenses.

Basic costs in foreign literature are called product costs, and overhead costs are called period costs.

Direct costs are the costs of producing a specific type of product. Therefore, they can be directly included in the cost of this type of product. These include the costs of raw materials, basic materials, wages of production workers, etc.

Indirect costs are associated with the production of several types of products, for example, the costs of management and maintenance of production.

Variables are costs whose value changes with changes in the volume of production and sales of products. These include the consumption of raw materials, fuel and energy for technological purposes, wages of production workers, etc.

Constant costs include costs whose value does not change or changes slightly with changes in production volume. These include production maintenance and management costs.

Some costs are mixed because they have both variable and fixed components. These are sometimes called semi-variable or semi-fixed costs. For example, the cost of electricity spent for technological purposes and lighting. Therefore, when accounting and analyzing them, it is necessary to clearly distinguish between variable and fixed costs.

Current expenses include the costs of production and sales of products for a given period. They have generated income in the present and have lost the ability to generate income in the future. Deferred expenses are expenses incurred in the current reporting period, but to be included in the cost of products that will be produced in subsequent reporting periods (for example, costs for the preparation and development of new types of products at existing enterprises). Such expenses should generate income in the future. Forthcoming includes costs that have not yet been incurred in a given reporting period, but in order to correctly reflect the actual cost, they must be included in production costs for a given reporting period in the planned amount (expenses for paying workers' vacations, etc.).

Based on costing criteria, costs are classified according to economic elements and costing items.

An economic element is usually called a homogeneous type of cost for the production and sale of products, which at the enterprise level cannot be decomposed into its component parts. For all enterprises, a single list of cost elements has been established: material costs, labor costs, social contributions, depreciation and other costs.

Element-by-element grouping of costs shows how much of certain types of costs were incurred throughout the enterprise as a whole over a certain period of time.

However, the classification of costs by economic elements does not allow calculating the cost of individual types of products or establishing the amount of costs of the structural divisions of the enterprise. To solve these problems, a classification of costs by costing items is used. It allows you to determine the purpose of expenses and their role, organize control over them, and identify quality indicators of economic activity of both the enterprise as a whole and its individual divisions.

To monitor and manage costs, it is also advisable to group and take into account the breakdown of production, workshops, sections, departments, teams and other structural divisions of the enterprise, i.e., by places of cost generation and responsibility centers. This grouping of costs allows you to organize internal commercial calculations and determine the production cost of products.

Cost analysis is carried out in the following areas: analysis of costs per 1 rub. volume of products; analysis of product costs by elements and cost items; factor analysis of product costs using the principal component method; cost analysis of the most important types of products.

Analysis of costs per 1 rub. volume of production includes studying the dynamics of costs compared to the previous period, determining the factors and reasons for deviations of the actual costs of the reporting period from the data for the previous period and their quantitative measurement.

When analyzing the cost of the most important types of products, the size of absolute deviations from the planned cost and the cost of the previous year is determined, the structure of costs for costing items is studied, and the causes of deviations are identified.

Which costs are fixed?

Fixed costs are those costs that do not depend on production volumes. Together with the variables, they constitute the total costs of the organization. Even if the company stops for a while, these expenses will not stop. Throughout the year they are always about the same.

Important!

However, when output reaches a certain level, fixed costs may change.

Example. LLC "SPECTR" is engaged in the production of paint and varnish products. Rental payments for the use of warehouse space in the company are classified as fixed costs. The amount is 35,000 rubles and does not change from month to month. But this year, as part of the implementation of thoughtful management decisions, SPECTRUM LLC is increasing its production volume. There is a need to use a warehouse area larger in area than what is available. The organization renegotiates the lease agreement. The new landlord is already asking 50,000 rubles a month for his services, since his warehouse is much larger. Thus, upon reaching a certain level of output volume, the fixed costs of SPECTRUM LLC increased.

Among the advantages of constant spending is the ease of planning. They do not change from period to period, as a result of which there are no “surprises” to be expected in this area. But the disadvantage of such expenses is that even with zero output they will not go anywhere and the enterprise will have to pay for them.

Variable and fixed expenses appear when creating a model of a company's break-even point.

It is taken to be the level of production at which operating profit covers total costs (both fixed and variable). From this moment the company becomes self-sustaining.

The break-even point is calculated to get answers to some important questions.

- At what production and sales volumes will the company remain profitable? What production volumes will ensure its competitiveness?

- What is the sales volume that guarantees the financial stability of the company?

It is noteworthy that gross receipts (margin) at the break-even point are equivalent to constant expenses. And the greater the excess of gross income over costs, the more profitable the production.

What costs depend on production volume

As noted above, the costs of an enterprise, based on the principle of dependence on production volume, are divided into constant and variable. This is necessary to optimize and plan all expenses, as well as to facilitate the search for ways to reduce them.

Individual expenses increase with production growth, that is, they depend on its volume. They are called variables. The most obvious feature of the variable components of all expenses is manifested in proportional expenses, which grow in the same proportions as the size of output.

Example. To create the product you need 6 liters of material. The cost of this material is 150 rubles per liter. It turns out that when producing 100 units of a product, the costs will be the following amount:

100*150*6 = 90,000 rubles.

Let's assume that the production volume doubles, that is, the output will no longer be 100, but 200 units of product. Then the cost will change as follows:

200*150*6 = 180,000 rubles.

That is, there is a direct proportional relationship here. A twofold increase in output entailed a twofold increase in expenses.

In the example considered, the so-called “economy of scale” was not taken into account. Many suppliers provide volume discounts, which makes costs less proportional to production volumes.

Examples of fixed costs

In almost any organization, the structure of fixed costs contains the following items:

- Depreciation charges for fixed assets (if the accounting policy adopts the linear method, which provides for uniform transfer of value);

- Remuneration for permanent salaried employees;

- Mandatory contributions to the payroll funds of these employees;

- Financing the recruitment and training (retraining) of staff;

- Management costs and administration costs;

- Representation expenses;

- Payment to landlords for the use of warehouses, workshops, etc.;

- Payment for housing and communal services;

- Financing of socially oriented objects on the balance sheet of the organization;

- Payment of interest rates;

- Payment of property taxes;

- Transfer of land tax;

- Payment for services provided by third-party companies (security, cargo transportation, advertising agencies, etc.).

In relation to the cost of production, such costs are usually indirect. That is, between specific types of products they are distributed in proportion to some base.

Specific fixed costs

During cost analysis, special attention is paid to the study of specific fixed costs. They represent part of the fixed costs per unit of product. An increase in production volumes entails a reduction in specific fixed costs.

This relationship can be clearly seen with an example.

Example. According to the accounting registers of GRADIENT LLC, the total value of the company's fixed costs for the time period under consideration amounted to 200,000 rubles. During this period, 8,000 units of the product were produced. It turns out that at this time the specific fixed costs were:

200,000/8,000 = 25 rubles.

The following month the amount of fixed costs has not changed. But production volume increased to 20,000 units. And the specific fixed costs now change:

200,000/20,000 = 10 rubles.

That is, the amount of specific fixed expenses has decreased significantly.

But fixed costs remain static up to a certain point. Upon reaching its level of production volume in each case, the constant component of all costs can also change - decrease or increase. An example with rent was given earlier. The same applies to depreciation charges. An enterprise that has expanded its economic turnover is forced to purchase new equipment, which, accordingly, will entail an increase in variable expenses in terms of depreciation.

What is included in production costs?

Production cost includes:

- raw materials - what a product is made from;

- wages and insurance contributions of employees in production;

- workshop rental;

- public utilities;

- depreciation of equipment or building.

In the simplest case, if a company produces only one type of product, all these expenses for a month can be summed up and divided by the volume of products produced. Production costs include only those raw materials and supplies that were used. If a ton of raw materials was purchased, and three hundred kilograms were used for production in a month, only their cost is included in the cost price. The rest is reserves that do not affect the calculation.

Mikhail has a dumpling production company, the business is profitable, there are regular customers and trusted suppliers. At a certain stage, I wanted to know whether it was possible to sell products cheaper in order to capture a larger market share and squeeze out competitors. To do this, we decided to calculate the cost of production. Mikhail records all operations in the PlanFact service, so it was easy to understand how much was spent on production. The expenses were collected in a table:

To calculate the depreciation of the refrigeration chamber, its price was divided by the expected service life in months. The purchase price is 36,000 rubles. Estimated service life is 3 years or 36 months. Depreciation per month: 36,000: 36 = 1,000 (rub.)

In March, Mikhail’s company produced 2,000 kilograms of dumplings, the cost of one kilogram was 164 rubles: 328,000 : 2,000 = 164 (rubles)

Mikhail entered this amount into the discount calculator to estimate what price he could offer customers in order to increase market share.

What to do if some of the products have not gone through all stages of production, and production is not completed at the end of the month? How, then, is the cost calculated? For example, at the beginning of the month, work in progress amounted to 50,000 rubles. 200,000 rubles were spent per month, and at the end of the month the amount of work in progress was 20,000 rubles. 1000 units of products were produced.

Calculating the cost of production in this case will look like this:

Unit cost = (Work in process at the beginning of the month + Money spent on production for the month - Work in process at the end of the month) : Quantity of goods produced

Unit cost of production = (50,0000) : 1000 = 230 (rub.)