In mathematics, a percentage is one hundredth of a number. For example, 5% of 100 is equal to 5. This calculator will allow you to accurately calculate the percentage of a given number. There are various calculation modes available. You will be able to make various calculations using percentages.

- The first calculator is needed when you want to calculate the percentage of the amount. Those. Do you know the meaning of percentage and amount?

- The second one is if you need to calculate what percentage X is of Y. X and Y are numbers, and you are looking for the percentage of the first in the second

- The third mode is adding a percentage of the specified number to the given number. For example, Vasya has 50 apples. Misha brought Vasya another 20% of the apples. How many apples does Vasya have?

- The fourth calculator is the opposite of the third. Vasya has 50 apples, and Misha took 30% of the apples. How many apples does Vasya have left?

Share in the economy in simple words

The share in the economy is calculated to determine the influence of one part of the instrument on the entire item. In simple terms, an enterprise uses an indicator to determine how a particular fragment affects the overall condition. For example, if the total cost per unit is determined, then all expenses are classified and then it is determined what the company spends the most money on.

Take our proprietary course on choosing stocks on the stock market → training course

The share is also calculated when analyzing the overall financial and economic activities of the enterprise. In this case, the company's expenses and income are taken into account. Often, a balance sheet is used to identify the value of an indicator. Specific gravity is usually measured only as a percentage. Moreover, the whole item will always be equal to 100%.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Which costs are fixed?

Fixed costs are those costs that do not depend on production volumes. Together with the variables, they constitute the total costs of the organization. Even if the company stops for a while, these expenses will not stop. Throughout the year they are always about the same.

Important!

However, when output reaches a certain level, fixed costs may change.

Example. LLC "SPECTR" is engaged in the production of paint and varnish products. Rental payments for the use of warehouse space in the company are classified as fixed costs. The amount is 35,000 rubles and does not change from month to month. But this year, as part of the implementation of thoughtful management decisions, SPECTRUM LLC is increasing its production volume. There is a need to use a warehouse area larger in area than what is available. The organization renegotiates the lease agreement. The new landlord is already asking 50,000 rubles a month for his services, since his warehouse is much larger. Thus, upon reaching a certain level of output volume, the fixed costs of SPECTRUM LLC increased.

Among the advantages of constant spending is the ease of planning. They do not change from period to period, as a result of which there are no “surprises” to be expected in this area. But the disadvantage of such expenses is that even with zero output they will not go anywhere and the enterprise will have to pay for them.

Variable and fixed expenses appear when creating a model of a company's break-even point.

It is taken to be the level of production at which operating profit covers total costs (both fixed and variable). From this moment the company becomes self-sustaining.

The break-even point is calculated to get answers to some important questions.

- At what production and sales volumes will the company remain profitable? What production volumes will ensure its competitiveness?

- What is the sales volume that guarantees the financial stability of the company?

It is noteworthy that gross receipts (margin) at the break-even point are equivalent to constant expenses. And the greater the excess of gross income over costs, the more profitable the production.

What does specific gravity show?

As already mentioned, specific gravity shows the influence of one part on the whole object. For example, if an indicator of production costs is calculated, it can be used to understand where the company spent more money during the production of goods.

The indicator is also used to identify output per employee, per team and per workshop. To do this, the quantity of products produced by a calculation unit (an employee, a group of specialists or a department) is divided by the total number of goods manufactured and multiplied by 100. In this case, the specific gravity reflects the quality of the work of the employee, team or workshop.

Specific gravity helps determine:

- quality of distribution of food supplies;

- efficiency of the enterprise;

- feasibility of spending funds;

- main sources of income and expenses, etc.

To identify the dynamics of the share in the economic development of an enterprise, it is calculated for each indicator by year. In this way, you can understand how the structure of the company's assets and liabilities has changed.

Physical Sciences

In physics, specific weight is called weight measured per unit volume of a homogeneous substance.

Weight in the SI system is indicated in Newtons (N), and volume is calculated in cubic meters. Thus, the unit of the required characteristic becomes Newton per cubic meter (N/cub.m). It follows that this value determines the force with which one cubic meter of the measured substance acts on the support.

Physical formula: U.v. = Weight of the object, N / Volume of the object, cubic meters. m

.

Unlike mass, which simply characterizes an object, weight is a vector quantity, that is, it is a force that has a direction of application and describes the effect of the body on other objects. Under normal conditions on the surface of the Earth, the difference is imperceptible to us, not physicists. We often confuse these terms in conversation and are not at all worried about it. But it is still important to understand the fundamentally different meanings these concepts have.

If we use the mass of a body in the above formula, we get its specific gravity, or density. This parameter characterizes how much substance is contained in a unit volume and is measured in kg/cubic meter. m.

Body weight always remains the same, while weight can vary depending on the geographic latitude of the place and its altitude above sea level.

By representing the numerator of the fraction through the mass of the body multiplied by the acceleration of gravity, we can see the relationship between the two specific quantities:

U.V. = Object density * Gravity acceleration

.

Thus, we can say that specific gravity relates to the density of a substance in the same way as its weight relates to mass, and this ratio is equal to the acceleration of gravity at a particular point on the Earth.

Subject of specific weight in economics

The subject of specific weight in economics is any indicator that can be identified as a part of the whole. The subject is:

- Income. The company receives income from various types of activities. To understand which direction brings more profit, the share is calculated.

- Expenses. The enterprise spends funds not only on production, but also on other needs. The indicator is identified in order to determine the level of costs for a particular area of activity and the efficiency of spending money for each item.

- Assets. These include financial instruments through which the company makes a profit. As a rule, calculating the share of assets is necessary to determine the adequacy of the enterprise’s equipment and to track dynamics.

- Obligations. These include the company's monetary debts, including to suppliers and buyers, customers and creditors. The share of obligations is calculated to identify the significance of each of them and the degree of their influence on the costs of the enterprise.

- Production . To determine the profitability of the work of an employee, workshop and department, the specific gravity is calculated.

Important! The share can be identified for almost every economic indicator of a company’s activities.

Results

Due to the fact that variable costs change in direct proportion to production volume, and the same costs per unit of finished product usually remain unchanged, when analyzing this type of cost, the value per unit of product is initially taken into account.

In connection with this property, variable costs are the basis for solving many production problems related to planning. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Methodology for determining the share in the economy

In economics, share is calculated using formulas. Calculations can be carried out using two methods: manually or using computer programs. In the first case, the accountant creates a table with economic indicators that make up one whole, for example, he groups all assets. At the next stage, he calculates the specific gravity for each characteristic and enters it into the appropriate window. As a result, each indicator has its own specific weight, expressed as a percentage of the total volume.

Important! To check the correctness of the calculations, it is enough to add up all the results of the specific gravity. If it turns out to be 100%, then the calculations were carried out correctly.

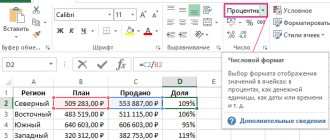

It is much easier to identify specific gravity using specialized computer programs. Today there are many electronic services created specifically for accountants. However, they are often purchased for a fee. To avoid unnecessary costs and reduce the time for calculating specific gravity, you can use the standard Excel program.

Formula for calculating specific gravity

To calculate the share in the economy, the general formula is used:

UdV = H/C * 100,

where UdV – specific gravity;

Ch – part of a whole object;

C – a whole subject.

The formula is used to calculate the share of all economic indicators, adjusting it to each of them. For example, the expression for determining the share of a company's income is as follows:

UDVD = VD / OSD * 100,

where UDV is the share of income;

Вд – the amount of receipts for one type of activity;

TSD is the total amount of the company’s revenue for all types of activities.

To apply the formula for calculating the share of other economic indicators, it is necessary to change the dividend to the determinable factor of the whole object and the divisor to the total amount of the instrument.

Determining Specific Gravity in Excel

To identify the share of economic indicators of an enterprise's activities, you can use the standard Excel computer program. It will help facilitate and speed up the calculation process. In addition, the risk of making mistakes is reduced.

To use an Excel spreadsheet to determine specific gravity, you only need to have basic programming knowledge.

General definition

They serve as micromodels of various phenomena in the financial activities of both the state in general and the business entity in particular. They are subject to various fluctuations and changes in connection with the reflection of the dynamics and contradictions of all ongoing processes; they can both approach and move away from their main purpose - assessing and measuring the essence of a particular economic phenomenon. That is why the analyst must always remember the goals and objectives of the research conducted using indicators for assessing various aspects of enterprise activity.

Theoretically, we can imagine that the final urine arises from an isomolar glomerular filtrate to which the renal tubules are added, or, on the other hand, is resorbed into pure, so-called free-flowing water. Osmometers are used to accurately determine osmolality. They use dissolved particles to influence certain properties of the solution.

Reduce the hardening point of the solution; increase the boiling point of the solution; Reduce the solvent vapor pressure above the solution. The magnitude of the change in the above values depends on the concentration of osmotically active substances in the measured solution, and osmometers record these changes with great accuracy. As a rule, a decrease in the pour point was found.

Among the many economic indicators compiled into a certain system, it is necessary to highlight the following:

- natural and cost, which depend on the selected meters;

- qualitative and quantitative;

- volumetric and specific.

It is the latter type of indicators that will be given special attention in this article.

Orientation by calculation from relative density

This calculation fails if the urine contains a high concentration of other substances that are physiologically present in a lower order, such as with severe glycosuria or ketonuria. If the urine contains protein or sugar, the relative density must first be corrected.

Kidney concentration test

Reduced kidney capacity is one of the first signs of kidney disease. We explore it as follows. This value indicates good bud concentration and, if successful, we do not continue with further research. The epinephrine test reflects the ability of the distal tubule and collecting duct to respond to adiuretin by producing concave urine. It is characterized by an enhanced antidiuretic effect, while other pharmacological effects are suppressed. The patient collects urine at four one-hour intervals and measures the osmolality of individual urine samples. If it exceeds the value shown in the table, it indicates good kidney concentration and the test is over. Along with urine, blood and serum osmolality are collected. From the urine and serum osmolality values, we calculate the osmotic index, which more accurately reflects the kidney concentration. First, we examine the osmolality in a morning urine sample. . Another possibility is to assess urine osmolality under varying fluid lengths, which is rarely performed today.

Example of specific gravity calculation

To better understand the process of determining the share of a company’s economic indicators, let’s look at an example based on:

| Economic indicator | Amount at the beginning of the reporting period, thousand rubles. | Amount at the end of the reporting period, thousand rubles. |

| Assets | ||

| Section 1: Non-current assets | ||

| NMA | 56,3 | 58,2 |

| OS | 125,63 | 125,63 |

| Long-term financial investments | 87,36 | 98,32 |

| Other noncurrent assets | 12,3 | 15,6 |

| Total for the section: | 281,59 | 297,75 |

| Section 2: Current assets | ||

| MPZ | 98,3 | 106,3 |

| VAT | 12,1 | 14,5 |

| Accounts receivable | 25,9 | 24,2 |

| Cash | 45,36 | 58,96 |

| Other current assets | 14,6 | 12,3 |

| Total for the section: | 196,26 | 216,26 |

| Total: | 477,85 | 514,01 |

| Passive | ||

| Section 3: Capital and Reserves | ||

| Authorized capital | 88,3 | 88,3 |

| Extra capital | 36,1 | 32,1 |

| Reserve capital | 55,3 | 34,2 |

| retained earnings | 56,2 | 65,3 |

| Total for the section: | 235,9 | 219,9 |

| Section 4: Long-term liabilities | ||

| Borrowed funds | 65,2 | 74,63 |

| Total for the section: | 65,2 | 74,63 |

| Section 5: Current Liabilities | ||

| Credits and loans | 96,3 | 125,69 |

| Accounts payable | 80,45 | 93,79 |

| Total for the section: | 176,45 | 219,48 |

| Total: | 477,85 | 514,01 |

Important! The income of the enterprise is reflected in the balance sheet as an asset, expenses - as a liability.

Calculation of the share of assets

First of all, let’s determine the share of current (UdVOA) and non-current assets (UdVVA) at the beginning and end of the reporting period:

UDVOA at the beginning of the reporting period = 196.26 / 477.85 * 100 = 41.07%:

UDVOA at the end of the reporting period = 216.26 / 514.01 * 100 = 42.07%;

UdVVA at the beginning of the reporting period = 281.59 / 477.85 * 100 = 58.93%;

UDVA at the end of the reporting period = 297.75 / 514.01 * 100 = 57.93%.

Now let’s find the specific weight for each asset:

| Economic indicator | Amount at the beginning of the reporting period, thousand rubles. | Amount at the end of the reporting period, thousand rubles. | Ud. weight at the beginning of the reporting period, in % | Ud. weight of the reporting period, in % |

| Section 1: Non-current assets | ||||

| NMA | 56,3 | 58,2 | 11,78 | 11,32 |

| OS | 125,63 | 125,63 | 26,29 | 24,38 |

| Long-term financial investments | 87,36 | 98,32 | 18,28 | 19,13 |

| Other noncurrent assets | 12,3 | 15,6 | 2,57 | 3,03 |

| Total for the section: | 281,59 | 297,75 | ||

| Section 2: Current assets | ||||

| MPZ | 98,3 | 106,3 | 20,57 | 20,68 |

| VAT | 12,1 | 14,5 | 2,53 | 2,82 |

| Accounts receivable | 25,9 | 24,2 | 5,42 | 4,71 |

| Cash | 45,36 | 58,96 | 9,49 | 11,47 |

| Other current assets | 14,6 | 12,3 | 3,05 | 2,39 |

| Total for the section: | 196,26 | 216,26 | ||

| Total: | 477,85 | 514,01 | 100 | 100 |

When calculating specific gravity, the result is often presented as a non-integer number. It must be rounded to the nearest hundredth. If after the hundredth the number is greater than 6, the last digit of the indicator is increased by 1.